This clause ensures that you have all the material to work with and are not held accountable in case this data is tainted. In addition to defining the services, this section of the bookkeeping service agreement also contains details pertaining to the rates corresponding to the services. It legitimizes your claim that the client has agreed to pay a certain sum at a particular rate for all the services that you render. You can charge flat service fees, hourly rates, or a monthly retainer depending on your business model and the nature of the project. The terms in this contract template are common to contracts for outsourced bookkeeping services.

FAQ about our Bookkeeping Contract Agreement Template

You should include language explaining that it is the full responsibility of the client to provide banking records and other financial information necessary to complete the engagement. The Accountant is hereby authorized to communicate with the Client’s custodian regarding the Client’s account and other relevant financial data. The Client will provide the Accountant with true and complete information necessary for the Accountant to perform its services.

Bookkeeping Guide for Freelancers and Independent Contractors

The terms of a simple accounting services agreement might change as the needs of your business and your client change. For the relationship to work, keep everything in order, talk to each other, and follow the agreement. Use this deal to set clear rules when hiring a bookkeeping firm to keep financial records, balance accounts, and do other related tasks. In the bookkeeping services agreement, both parties agree on the duration of their partnership. You should also check to see if your state has any specific requirements to make a service contract legal and binding to ensure your agreement is in accordance. A bookkeeping contract is a formal agreement between bookkeepers and clients laying out the terms and conditions of the nature of the work to be completed.

Sample Template

- It is also good you mention that the accuracy of the existing financial data provided is the full responsibility of your client.

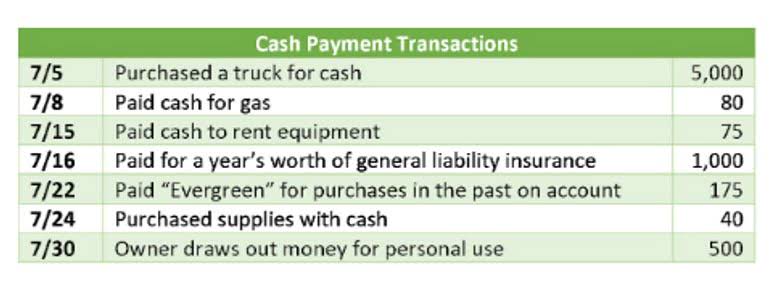

- Standard bookkeeping services include accounts payable, accounts receivable, monthly bank reconciliations, and financial statement preparation.

- Employees get paid a regular wage, have taxes withheld from those wages, work part or full-time, and have their work and schedule decided by the employer.

- While bookkeeping doesn’t often lead to legal action (and, of course, you should always maintain professional liability insurance), you should be prepared if an engagement does lead to legal action.

- Bookkeeping contracts might be necessary based on the services provided, the customer’s goals, and how much risk the customer perceives.

The Client and the Bookkeeper (“Parties”) agree to the following terms and conditions for the Bookkeeper’s services. The Bookkeeper will remain an independent contractor and will not be considered an employee of the Client. To keep the relationship strong, you and your client must be on the same page regarding your responsibilities. (a) This Contract may be terminated by either party by giving 30 days advance written notice to the other party.

DIY or Hire a Professional?

An engagement letter, on the other hand, is a more focused document outlining the specifics of a particular project within the larger framework of the contract. Depending on several factors, making a bookkeeping services agreement can take a few hours to a few days. As you can see, a bookkeeping service agreement is a must for all bookkeeping service transactions. Bookkeeping is a time and labor-intensive task, so it is only fair to ensure that you and your interests stay protected. Bookkeeping helps develop and maintain a business’s financial processes and management.

- While it is not compulsory to have a contract in place to get bookkeeping services, it is always recommended that bookkeepers have a contract in place for their own and their client’s benefit.

- Just because a client is making use of your services, it does not mean that they own your intellectual property.

- Since both the company’s books and the bank statement have an adjusted balance of $6,975 the bank statement has been reconciled.

- Thus, the role of a bookkeeper is crucial in maintaining the financial health of an organization.

- The signatures below indicate entire agreement and the Parties entering into this contract.

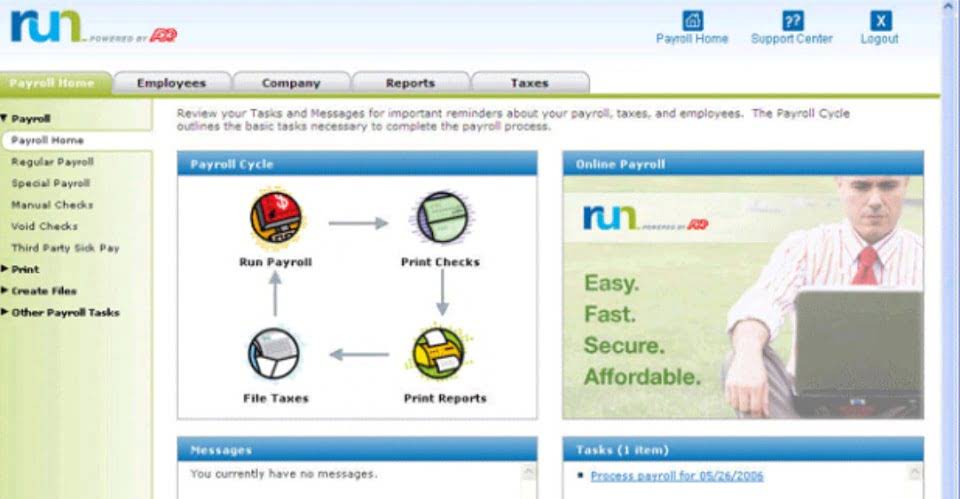

It is very important for big projects, ongoing agreements, or situations where you need to share personal financial information. If you and your team struggle to keep track of multiple promised delivery dates, it’s time to implement a workflow accountant for independent contractor management tool. The earlier you can integrate a workflow management tool into your practice, the easier it will be to maintain as your practice grows. The signatures below indicate entire agreement and the Parties entering into this contract.

Where To Use a Bookkeeping Agreement

Accountants and bookkeepers are professionals in handling, creating, and analyzing financial data. Besides the financial documents you create and analyze, the bookkeeping contract template is one you must not joke with if you consult for clients. You need a bookkeeping agreement set in place to work with a new client successfully. As I mentioned earlier, independent contractors are not employees—they are self-employed and work for clients on a contract basis.

Bookkeeping Contract Sample

You need to keep complete records of all financial transactions carried out due to the accounting service agreement. How and when the client pays you for your services should be mentioned in the accounting service agreement. When you intend to raise the bill, either monthly or a lump sum, and when the client needs to pay you. Apart from the duration of the agreement, you should mention that services beyond the expiry date of the accounting service agreement shall be provided but with extra compensation.

Term and Termination